We received this thought provoking e-mail from a viewer Derick Finlayson two weeks back:

“Given all the erudite advice on what to buy and sell, it would be very useful if you could please reiterate the key tax issues that should be born in mind in executing a bond, property & equity asset allocation strategy.”

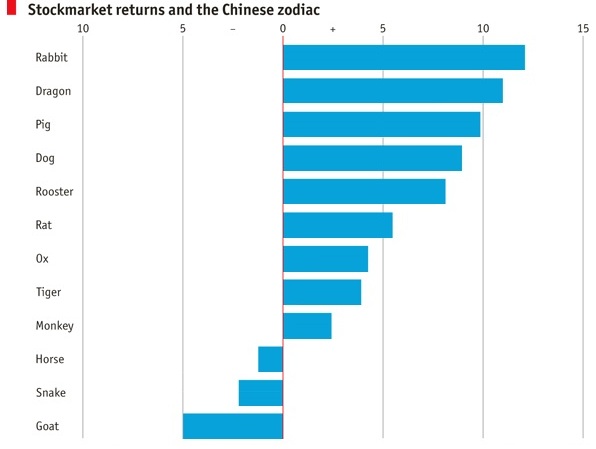

I like where he is going with this. He is implying that the vast majority of the “erudite” commentary on shows like this, and in newspapers and magazines appears to be about timing, and the inevitable question: if I buy this asset now, will it go up in value, so that I can sell it later for a profit?

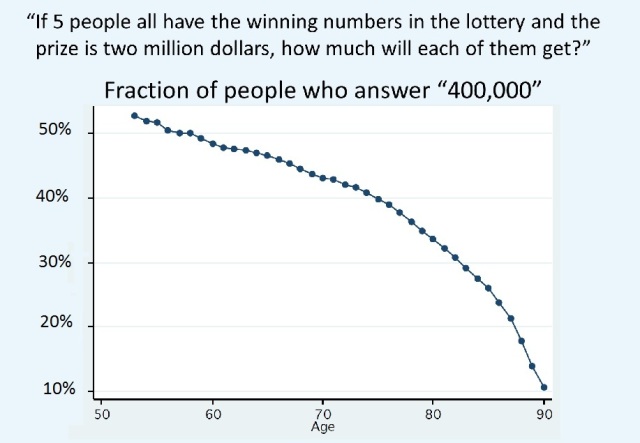

When you think about it, this approach suggests that we are all speculators, buying and selling the whole time, to supplement out incomes.

In reality, this is just not true. In fact, most of us are investing, in order to turn income into capital. In other words, we are saving our salaries, bonuses, inheritances, profits from businesses or other inflows, and building up assets.

Assets might be equities, properties, and perhaps even government bonds.

Now, what about the issue of taxes? Well, if you speculate in any asset class, be it listed shares or properties, then the tax authorities will deem you to be a trader, and tax you on your profits (if you have any). Plus, the transaction costs and the paperwork are both a huge pain in the ass!

In addition, many countries have capital gains taxes which kick in on assets which you hold for investment purposes, which you sell in order to realise that gain. Here in South Africa, the rule is three years. Hold an asset for that long or more, sell it, and CGT kicks in.

Finally, we have the issue of estate duties, otherwise known as death taxes! This is payable, above a certain threshold, once both you and your surviving spouse have croaked.

So here you go folks, here is my answer to Derick’s rather nuanced question. It’s quite simple. Buy quality, get paid to hold it and never sell.